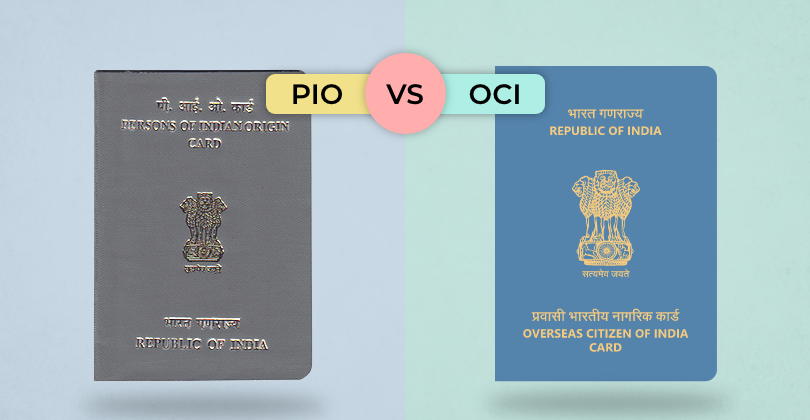

Are you of Indian origin and living abroad? You've probably come across terms like PIO and OCI. These cards offer different benefits, but it can

It’s a well-known fact that kids grow up by learning and observing everything around them. What they see, they eventually do. Be it sharing their belongings with others, how to cope with anger and frustrations healthily, or even talking about their feelings, kids will be encouraged to do these things themselves if they see their parents do it too. If you're a parent, you'll know the importance of helping shape your child's behaviour through your actions. However, parents almost always leave out one aspect of behaviour, and that's good money management.

As a parent, how often (if at all) have you talked to your children about money? If they're teenagers or young adults, these conversations are essential, as they can dispel many myths that they may have subscribed to by watching you deal with money. For example, suppose you use credit cards for daily expenses. In that case, your child might already think that a credit card equals access to unlimited cash. Or, he/she may think that getting a small personal loan is possible for everybody. Busting such myths is critical, as it can prevent dangerous mistakes in the future. Here are some tips that you, as a parent, can use to teach your children to manage money effectively:

1.Break Down Pocket Money

One of the most common misconceptions children have about pocket money is that they can spend it as they see fit. While that's obviously not true, it can be challenging to make teenagers see reason if they've made up their mind about using their pocket money a certain way. An effective way to give your children a lesson in Budgeting 101 is by breaking down their pocket money. Teach them that not every rupee needs to be spent on the latest video game/pair of sneakers. When they get pocket money, or little sums of money as gifts from relatives, put aside a portion towards savings as well.

📗 Related Blog- 3 Skills You Need for Successful Personal Financial Management

2.Have a Savings Goal

If your children have their eyes set on a particular item they want to purchase, it can be hard to get them to change their minds. Spending a big chunk of their pocket money on just one thing is also dangerous, as they may get used to impulse buying in the future. As parents, here's where you can step in and teach them to keep savings goals. For example, if your son gets ₹2,000 every month and wants to buy the latest iPad Air, let them know that it’ll take over a year’s diligent saving up to save up that amount. If he wants to spend ₹500 on clothes, it'll delay him from meeting his goal. This is an essential lesson children need to learn instead of spending their pocket money on impulse purchases.

3.Always Comparison Shop

Also known as comparison shopping, this is a tactic that will help both children and adults save more while shopping. So, the earlier you teach your children to comparison shop, the better. For example, a particular smartphone model might cost less on Amazon than on Flipkart. There are several online shopping platforms in India today that can get your children (almost) anything they want. So, it would always help if they looked up the same item on different platforms since there's still a chance they might land a great deal or a discount on one of them. Along with comparing prices, teach your children to practice reading customer reviews as well. This will help them avoid spending money on bad/fake products.

📗 Related Blog- Get an Easy Loan Online for Urgent Financial Needs

4.Let Them Learn from Your Mistakes

Your children are bound to make mistakes while learning to manage money the right way, and that's okay. The earlier they know (when there's not much money involved), the better. It would also help if you talked to them about the mistakes you made while managing your money so that they can learn from them and avoid making the same mistakes themselves. Defaulting on the EMIs of a small personal loan, not paying your credit card bills on time, or applying for too many credit avenues at once – all these are mistakes your children can learn from. What's important is that they don't make these mistakes themselves.

In Conclusion

The above points are a few tips you can teach your kids to learn the value of money. As mentioned earlier, the best way to teach them is to be an example for them. Answer whatever questions they may have about credit, credit scores, or personal loans the best you can, as it'll help you understand how much your kids already know about finance. Speaking of personal loans, if you’re looking to get a small loan to meet your financial needs, KreditBee is an option you can consider. Our entire loan application process is quick and completely online on the KreditBee mobile app, from profile creation to disbursal. You just need to download our KreditBee loan app from Google Play, complete your profile, and relax. If you wish to learn more about our small personal loans, please write to us at [email protected].

AUTHOR

KreditBee As a market leader in the Fintech industry, we strive to bring you the best information to help you manage finances better. These blogs aim to make complicated monetary matters a whole lot simpler.